It’s your boy. What is he up to? Doing research, planning moves, stalking SPY.

My position : SPY : Sept 5th exp, 645s, 3 calls, $5.10 entry

I was short (took a small loss) & then reset long.

How did I come to the above conclusion?

During the trading day one should never rest. Checking your thesis, verifying data that supports your thesis, and testing for weakness in your thesis are paramount.

While managing my original short play, I started to check levels in the dark pool.

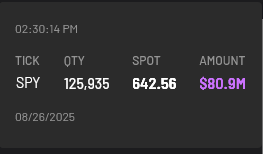

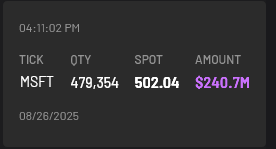

I found two prints in the afternoon that aroused my curiosity :

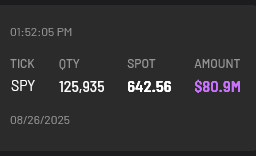

After that, I ran a quick search for the dark pool levels over the last 10 days :

What I can see is 643 to 645 levels are filling out & SPY is not going down.

That is to say, the prints I show above are both long plays by the same actor, the same amount of shares, with the same money spent. And, over the last 10 days, levels around 643-645 are filling out (volume with longs).

This is my opinion ; but , deduction via inference is what traders should be doing smartly & doing best. It’s a skill that one needs to hone to a fine edge.

Essentially, I have two data sets (the above prints & levels). With this data, I make a deduction : the Whales and Market Makers are setting up a new support level (accumulation).

Obviously, if these actors are long, the only way to profit is to move up & then sell (distribution). So if those actors bought $250m+ of dark pool shares from 643 to 645, their plan must be to go up.

Let’s take a second to think like a thief (market maker) and a rouge (whale)…

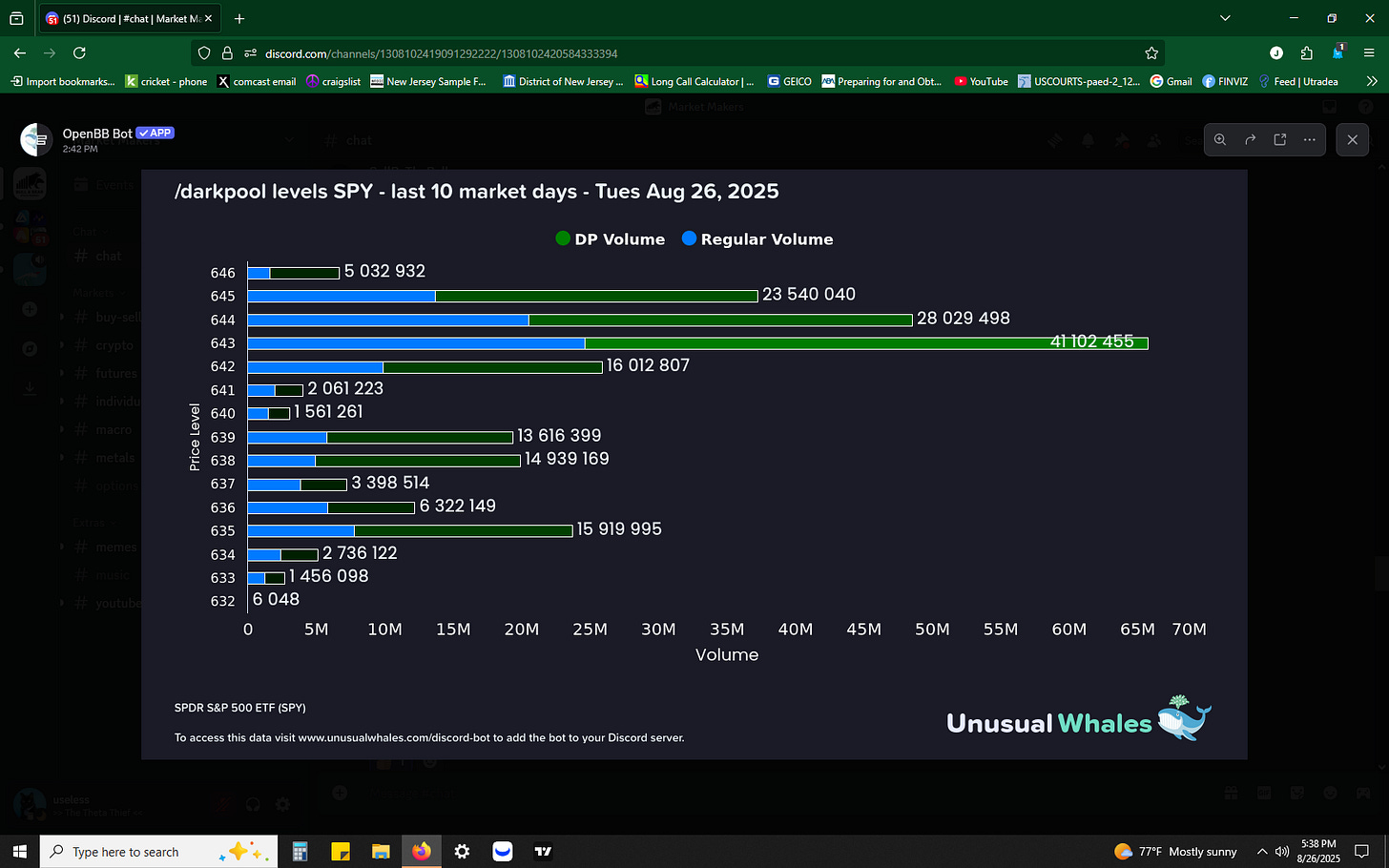

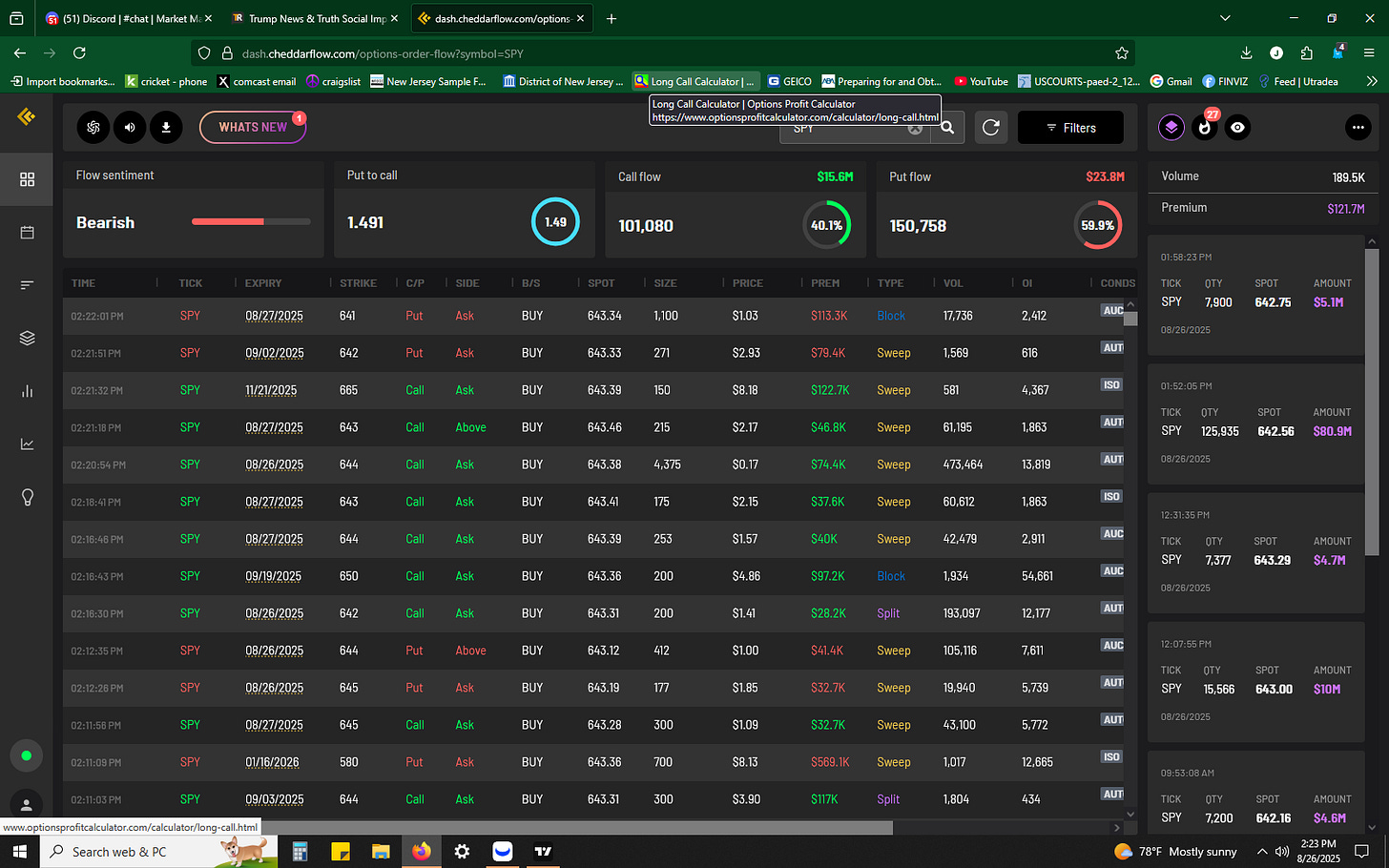

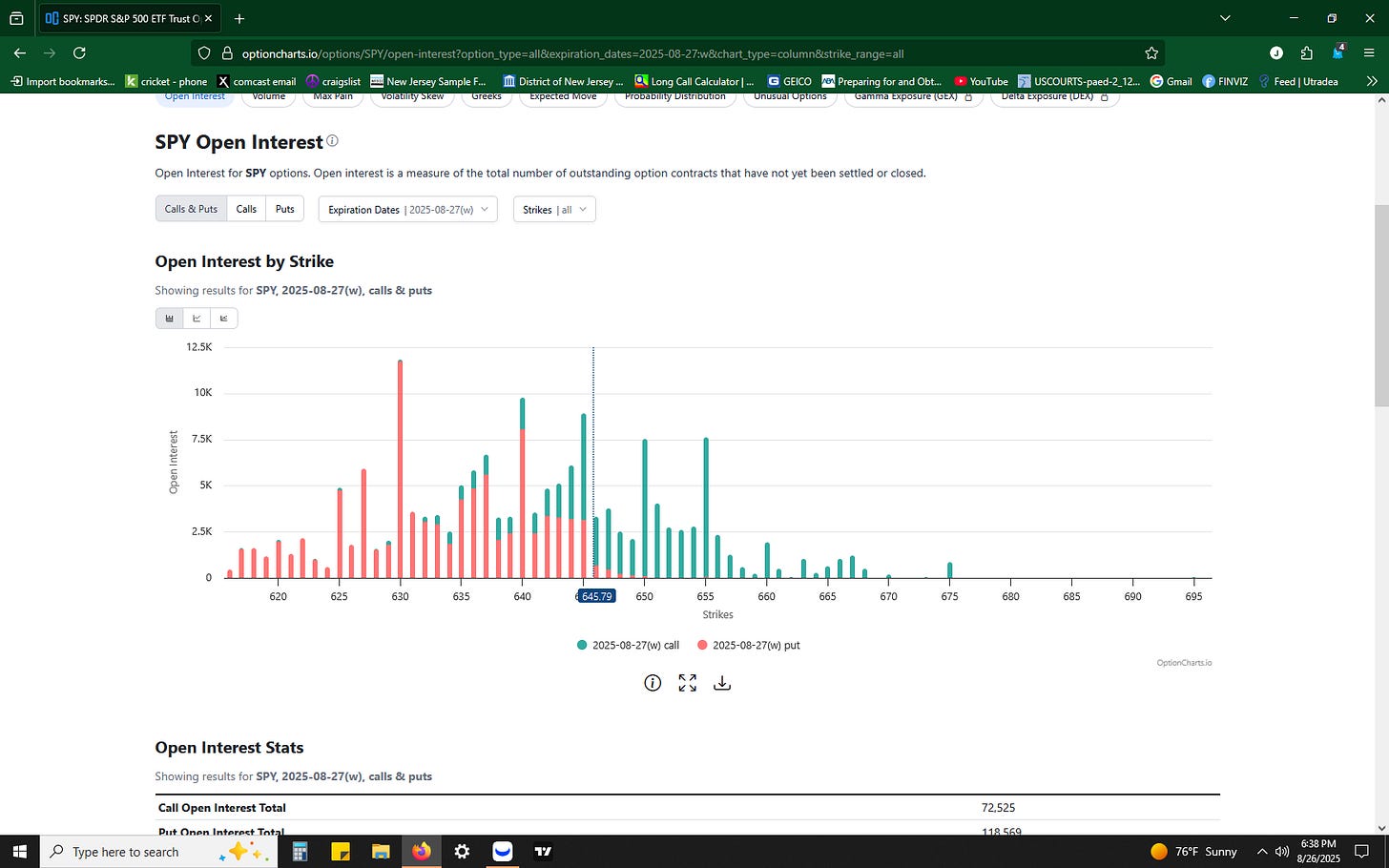

More SPY data… the higher OI is on the put side. It’s clear to see. If you were a thief would you not want to go to the place with the most money?

Useless, what the fuck are you trying to say?

My friends, the higher OI is on the put side, so the put side has more money, & therefore the put side is a great place for big players to take your money. Just the same, the put side OI shows there is potential to trap all these lazy traders out here.

Is that not what happened to shorts at the close today (they’re stuck)?

The above research is why I took an early loss on short (less than $200) to reset my play long.

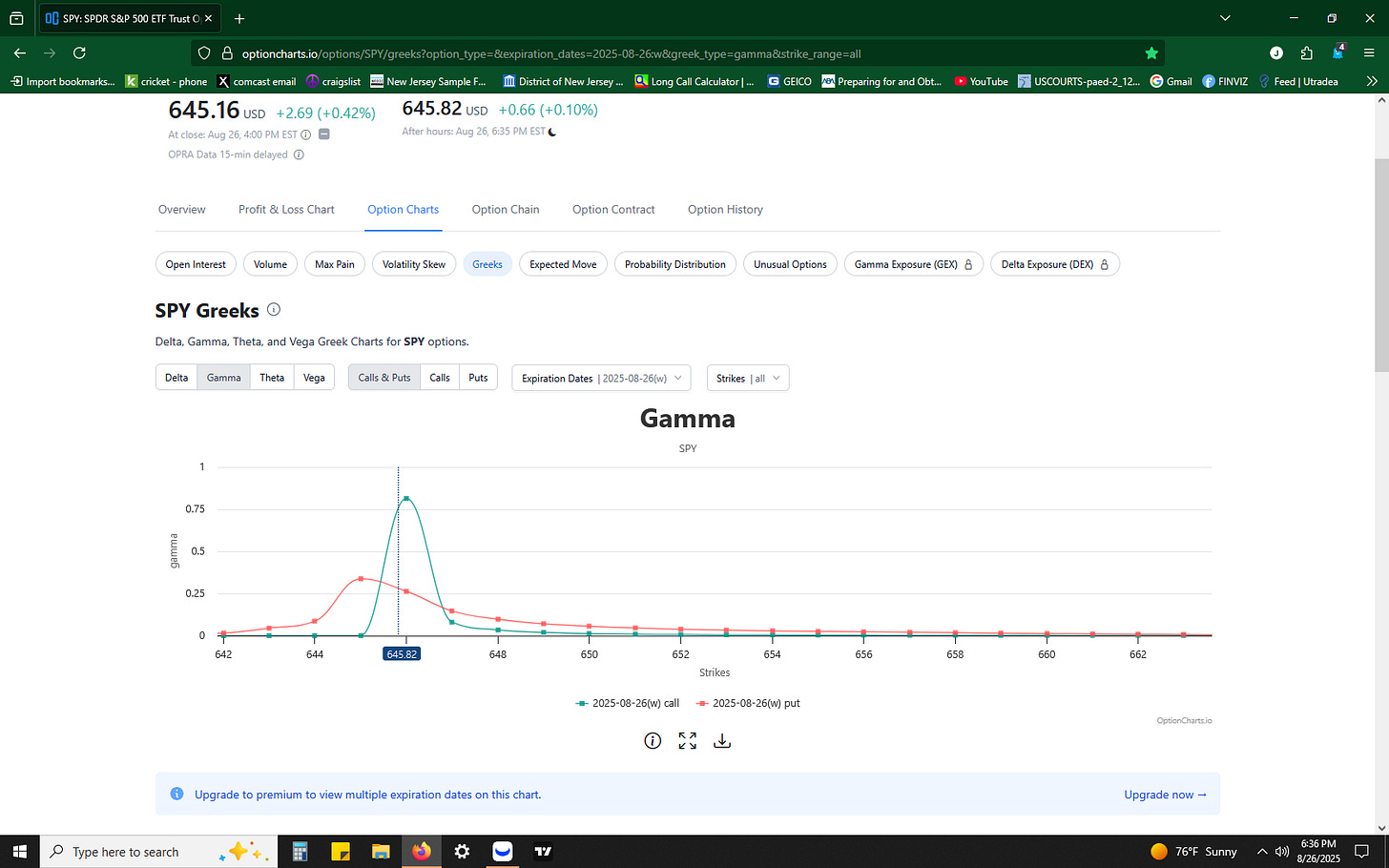

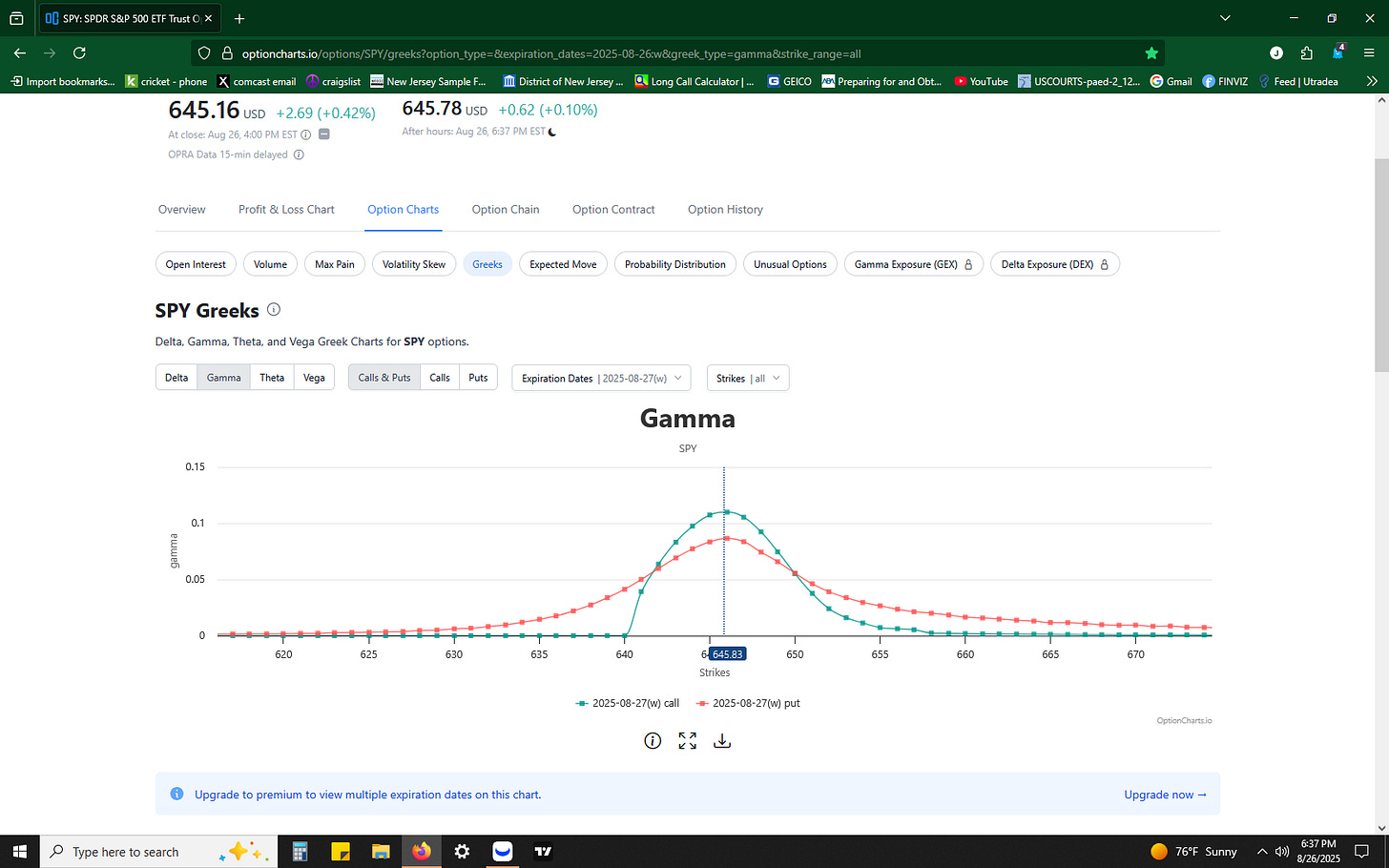

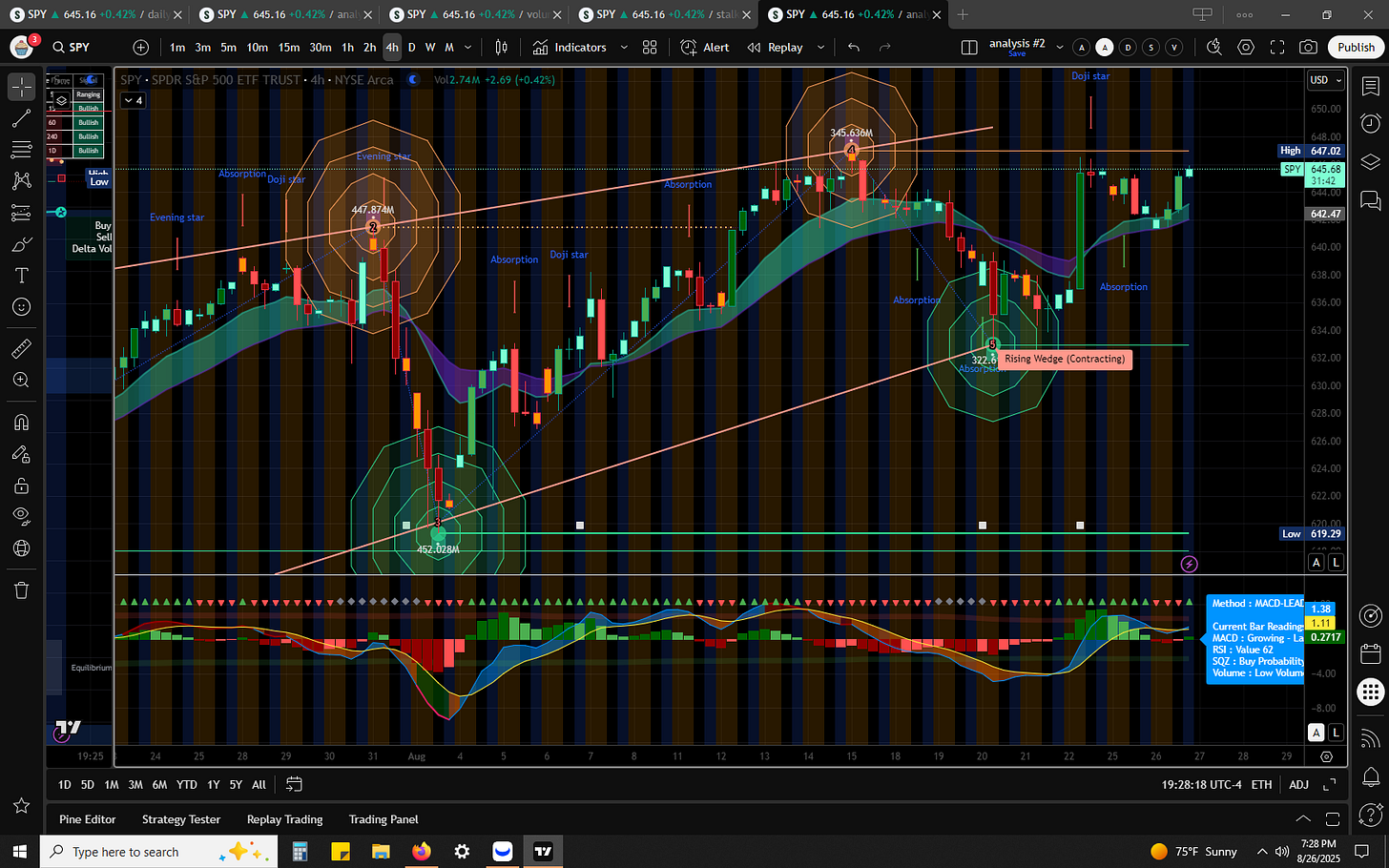

Is there anything else that could support the long hypothesis? How about Gamma Exposure (GEX) , open interest, and the 4hr chart?

^ at the close , GEX is +

^ tomorrow (8/27) , GEX is +

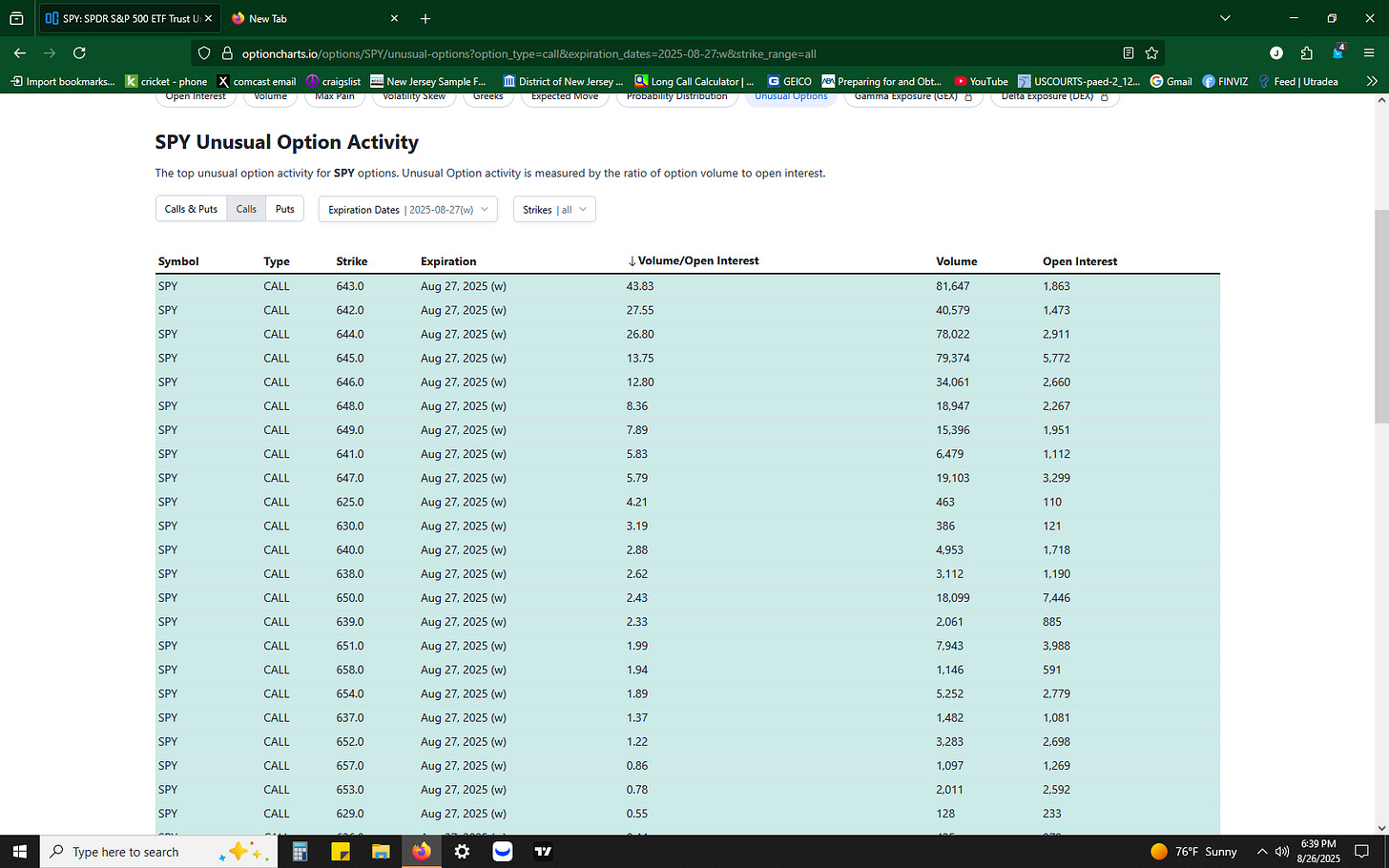

Note the order flow image I took this afternoon :

The players are showing what here? Note put to call ratio. It is bearish. When the put to call ratio is not parity, my mind immediately thinks (around 1.5+) the Market Makers are writing puts (it’s definitely not just bears buying puts). Remember how Market Makers work : in this instance when MMs are writing puts, to Delta hedge (which they must do to be Delta neutral) calls or shares must be bought (long). SPY especially after 2pm was showing some interesting bullish behavior.

We can see (from order flow) money flow is bearish too.

What do I always say about these thieves? When they short, they long (& vice versa). Here MMs showing short in order flow (in public) tells me they are setting up shorts for a reason… the big players will close their longs (they took in dark pool) and those longs will “fall into” their short plays… this is how the thieves set their trap…. this is how they work… this is how they make $bank. The big players (MMs and Whales) work in concert & they almost always set up their plays so that their longs (in our case this week) can be sold into their short positions (or vice versa). The every day trader looks at the same order flow and says what? The MMs & Whales are short & so am I - IMO that’s wrong !

Did I make the right move? Is my thesis solid? I say… yes.

MSFT, NVDA, AAPL will also help drive my SPY play. It’s no secret that the Mag7 can be utilized to trade SPY.

While two tickers were bullish & convergent today, one was not. MSFT pulled back all the way to 499s. Once I saw that, I checked dark pool and look what I found …there were several big$ MSFT prints afterhours :

Tomorrow I expect MSFT to run bullish. It’s something like 7% of SPY’s weight… if you add AAPL & NVDA, together they add so much weight to SPY that if those 3 are green, SPY has strong chance to run green.